Protel VUK 507 is the operating entity.

Since 2018, we have been working on solutions compliant with VUK 507 regulations, focusing on laws and notifications issued by the Revenue Administration (GİB). With our VUK 507 compliant solutions developed for hotels and restaurants, we enable businesses to have legal and secure financial processes, accelerate their digital transformation processes, and increase operational efficiency. As a result of our dedicated work, we are proud to announce that we are authorized by the GİB to provide services to taxpayers related to the preparation, transmission, receipt, and storage of electronic documents (e-Invoice, e-Archive Invoice, e-receipt, and other electronic documents) while working in full compliance with tax regulations, ensuring reliable and transparent financial reporting processes.

What is SFA (Secure Financial Application) or VUK 507?

GMU (Secure Financial Application) or VUK 507, is a legal regulation that requires businesses to carry out payment collection transactions in accordance with the legal rules specified by the Revenue Administration and to electronically create, transmit, and store the documents of these transactions to the relevant institutions.

What are the responsibilities of GMU in businesses?

The Secure Mobile Application (GMU) e-Certification System ensures that all transactions start and end securely. Additionally, it is the main application that operates centrally with other applications and includes all endpoint software.

With the GMU regulation, all shopping activities can be carried out using a payment recording device and allows for the electronic documents created at the end of the transaction to be queried and accessed from the GIB system when needed. For this purpose, businesses only need to have a certified or uncertified device.

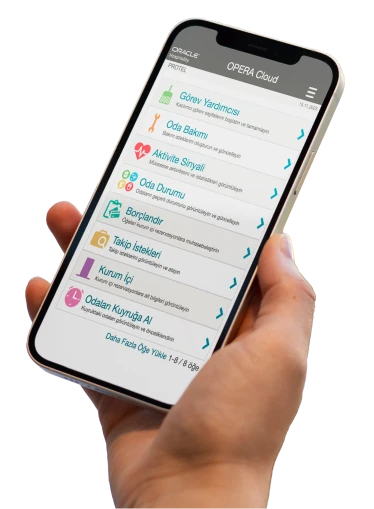

What is Protel e-Invoice POS?

Protel has developed an e-Invoice POS solution that meets the requirements of VUK 507, which can be used by both restaurants and hotels as well as customers of banks and payment institutions. This solution is designed to support a variety of different e-Document types from e-Invoice to e-Archive and has been made compatible with the most preferred integrators in the sector. The product has been developed to reach the highest standards in terms of technological infrastructure and security for banks. Today, with various payment integrations, certified/uncertified device options, and different document choices available in its product range, it seamlessly meets the VUK 507 needs of retail businesses.